Are you ready to uncover the captivating world of options trading strategies? Brace yourself as we embark on a journey through the intricacies of this financial realm. From the basics of options trading to the nuanced techniques employed by seasoned investors, we’ll shed light on the Long Call Strategy, the Short Put Strategy, and a variety of Bullish and Bearish Options Strategies.

Get ready to unlock the secrets that lie within the realm of options trading, where every decision holds the potential for profit or loss. Get ready to uncover the keys to success in the world of options trading strategies.

Basics of Options Trading

Understanding the fundamentals of options trading is crucial for developing successful trading strategies. When it comes to options trading, one of the key aspects to grasp is the concept of hedging strategies.

Hedging is a risk management technique that involves taking positions in options contracts to offset potential losses in an underlying asset. By using options to hedge, traders can protect themselves against adverse price movements and limit their downside risk.

There are different hedging strategies that traders can employ, depending on their specific objectives and market conditions. One popular hedging strategy is known as a protective put. This involves buying a put option on an underlying asset that the trader already owns. By doing so, the trader can limit their potential losses if the price of the asset declines.

Another hedging strategy is the collar, which involves buying a protective put and selling a covered call simultaneously. This strategy helps to limit both downside risk and potential upside gains.

Volatility trading is another important concept in options trading. Volatility refers to the amount of price fluctuation in an underlying asset. Traders can take advantage of volatility by using options strategies that profit from changes in volatility levels.

For example, when volatility is expected to increase, traders can buy options contracts to benefit from potential price swings. Conversely, when volatility is expected to decrease, traders can sell options contracts to collect premium income.

Long Call Strategy

The Long Call Strategy is a popular options trading strategy that allows traders to profit from a bullish outlook on a specific underlying asset. This strategy involves buying call options, which gives the trader the right to purchase the underlying asset at a predetermined price, known as the strike price, within a specified time frame.

The profit potential of the Long Call Strategy is unlimited, as the trader stands to gain from any increase in the price of the underlying asset. If the price of the asset rises above the strike price, the trader can exercise the call option and profit from the difference between the market price and the strike price. However, if the price of the asset doesn’t rise above the strike price before the option expires, the trader’s loss is limited to the premium paid for the call option.

To manage the risk associated with the Long Call Strategy, traders can set a stop-loss order to limit potential losses. Additionally, they can use technical analysis and market indicators to identify entry and exit points for their trades. By carefully monitoring the market and adjusting their strategies accordingly, traders can increase their chances of maximizing profit potential and minimizing risk.

Short Put Strategy

To capitalize on a bearish outlook on a specific underlying asset, you can employ the Short Put Strategy. This strategy involves selling options on the asset with the expectation that the price will either remain stable or rise. By selling put options, you’re essentially taking on the obligation to buy the underlying asset at a certain price, known as the strike price, if the option is exercised by the buyer. In return for taking on this obligation, you receive a premium from the buyer of the put option.

The Short Put Strategy is often used as a way to generate income in a market where you expect the price of the underlying asset to either remain stable or increase. However, it’s important to understand that this strategy also carries risks. If the price of the underlying asset falls significantly, you may be required to buy the asset at a higher price than the current market value.

To mitigate this risk, you can implement a protective put strategy by purchasing put options at a lower strike price. This will limit your potential losses in case the price of the underlying asset declines.

Bullish Options Strategies

Consider implementing bullish options strategies to take advantage of a positive outlook on a specific underlying asset. When you expect the price of an asset to rise, a covered call strategy can be implemented.

This strategy involves selling a call option on an asset that you already own. By doing so, you receive a premium for selling the call option, which acts as a buffer against any potential losses if the price of the asset doesn’t rise as expected. In addition, if the price of the asset does rise and the call option is exercised, you still benefit from the increase in the asset’s price. This strategy allows you to generate income while still maintaining ownership of the asset.

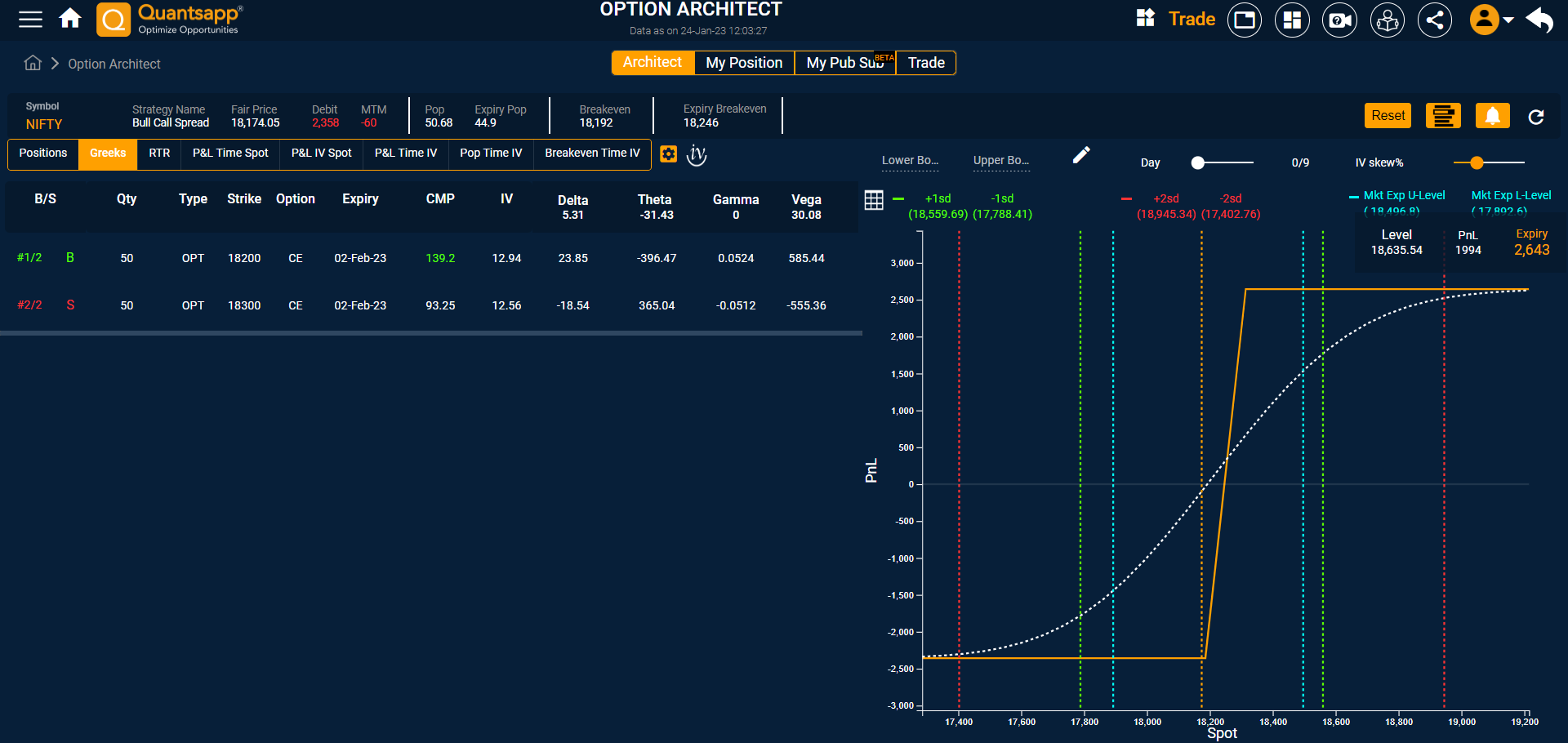

Another bullish options strategy to consider is the credit spread strategy. This strategy involves selling a call option with a higher strike price and simultaneously buying a call option with a lower strike price. The premium received from selling the call option offsets the cost of buying the call option, resulting in a net credit. If the price of the underlying asset increases, the call option with the higher strike price will be exercised, while the call option with the lower strike price will expire worthless. This strategy allows you to profit from the increase in the asset’s price while limiting your potential losses.

Both the covered call strategy and the credit spread strategy are effective ways to capitalize on a bullish outlook on a specific underlying asset. By understanding and implementing these strategies, you can take advantage of potential price increases while managing your risk.

Bearish Options Strategies

Implement bearish options strategies when you anticipate a decline in the price of a specific underlying asset. These strategies allow you to profit from falling prices or protect your portfolio against potential losses. Two popular bearish options strategies are the covered call and the put spread.

The covered call strategy involves selling call options on an asset that you already own. By doing so, you generate income from the premiums received, but you also cap your potential profit if the price of the asset rises above the strike price of the call options. This strategy is often used when you expect the price of the underlying asset to remain relatively stable or decline slightly.

On the other hand, the put spread strategy involves buying and selling put options with different strike prices. This strategy limits your potential profit but also reduces your downside risk. By buying a put option with a higher strike price and selling a put option with a lower strike price, you create a bearish position that benefits when the price of the underlying asset falls.

Both the covered call and put spread strategies provide you with the opportunity to profit from bearish market conditions. However, it’s important to carefully analyze the market and the specific underlying asset before implementing these strategies to ensure they align with your risk tolerance and investment goals.

Frequently Asked Questions (FAQs):

What Are the Risks Associated With Options Trading?

What are the risks associated with options trading? You should be aware that options trading involves potential losses and can be highly volatile. However, by employing hedging strategies, you can mitigate some of these risks.

How Can I Determine the Best Time to Enter or Exit an Options Trading Position?

To determine the best time to enter or exit an options trading position, you need to employ timing analysis and develop effective exit strategies. This will help you make informed decisions based on market trends and maximize potential profits.

Are There Any Tax Implications Specific to Options Trading?

There are tax implications to consider when engaging in options trading. These tax considerations can impact your overall profitability and should be carefully analyzed and factored into your trading strategy.

Can Options Trading Be a Suitable Investment Strategy for Beginners?

Options trading can be a suitable investment strategy for beginners. It offers potential high yields, but there is a learning curve. Resources and education are available to help beginners understand the technical and strategic aspects.

Are There Any Regulatory Requirements or Restrictions for Options Trading?

You must heed the regulatory requirements before diving into options trading. Margin requirements are one such constraint. Ensure you understand and comply with these rules to navigate the strategic waters of options trading successfully.